The Pudgy Penguins NFT floor price prediction has become one of the most sought-after topics in the digital asset space as investors seek to understand the future value potential of this iconic collection. With over 8,888 unique penguin NFTs capturing hearts across the Web3 community, the collection has demonstrated remarkable resilience and growth since its 2021 launch. The recent introduction of the PENGU token and strategic partnerships with major retailers like Walmart and Target have significantly influenced market sentiment, making accurate Pudgy Penguins NFT floor price prediction analysis more crucial than ever for both seasoned collectors and newcomers exploring NFT investment opportunities.

Current Market Analysis of Pudgy Penguins NFT Collection

The pudgy penguins price analysis reveals fascinating market dynamics that distinguish this collection from other blue-chip NFT projects. Currently trading with a floor price range between 15-16 ETH, Pudgy Penguins has maintained its position as one of the top-performing NFT collections despite broader market volatility. The collection’s unique combination of adorable artwork, strong community engagement, and strategic business development has created a solid foundation for sustained value growth.

Market capitalization data shows Pudgy Penguins consistently ranking among the top 5 NFT collections by total value, with daily trading volumes often exceeding 100 ETH. This ethereum NFT investment opportunity has attracted both retail collectors and institutional investors who recognize the project’s potential for long-term appreciation. The collection’s 5,081 unique holders demonstrate healthy distribution, avoiding the concentration risks that plague many NFT projects.

Key Market Metrics and Performance Indicators

The NFT market trends surrounding Pudgy Penguins reveal several positive indicators for future price appreciation. Trading velocity remains strong with consistent buyer interest, while holder retention rates exceed industry averages. The project’s social media presence, boasting over 50 billion cumulative views across platforms, translates directly into sustained demand and price stability.

Recent sales data indicates premium traits command significantly higher prices, with rare attributes like unique backgrounds, special accessories, and distinctive facial expressions driving values well above floor price levels. The most expensive Pudgy Penguin, #6873, sold for 400 ETH (approximately $640,000), demonstrating the collection’s potential for extraordinary appreciation in exceptional cases.

Pudgy Penguins NFT Floor Price Prediction Short-Term Outlook (2025)

The Pudgy Penguins NFT floor price prediction for 2025 presents compelling opportunities driven by several catalytic factors. Industry analysts project floor prices potentially reaching 25-35 ETH by year-end, representing substantial upside from current levels. This optimistic outlook stems from the successful PENGU token launch, expanding retail partnerships, and growing mainstream adoption of the Pudgy Penguins brand.

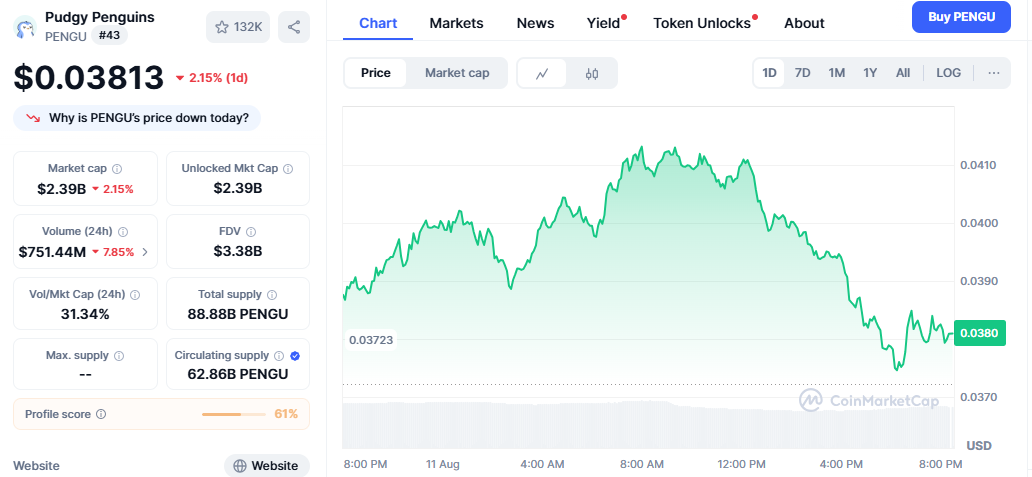

PENGU token value dynamics play a crucial role in short-term price movements. With over $137,000 worth of airdrop tokens distributed per NFT holder, the relationship between token performance and NFT values creates interesting arbitrage opportunities. As PENGU token utility expands within the Pudgy ecosystem, including future metaverse integrations and governance functions, this should provide additional value accrual to NFT holders.

Market Catalysts Driving 2025 Price Projections

Several Web3 investment opportunities are converging to support bullish price predictions for 2025. The planned launch of Pudgy World, an immersive 3D virtual environment, will create new utility for NFT holders while attracting additional users to the ecosystem. Early access privileges and exclusive content within this platform should drive premium valuations for Pudgy Penguins NFTs.

Strategic partnerships continue expanding the brand’s reach beyond traditional crypto audiences. The success of physical toy sales through major retailers validates the intellectual property value embedded in each NFT, creating tangible asset backing that supports higher floor prices. Additionally, the planned animated series and multimedia content development should significantly enhance brand recognition and collector demand.

Medium-Term Price Analysis 2026-2027 Projections

Cryptocurrency market analysis suggests the 2026-2027 period could mark a significant maturation phase for the Pudgy Penguins ecosystem. Conservative estimates project floor prices stabilizing in the 30-50 ETH range, while optimistic scenarios envision breakthrough moments pushing valuations toward 75-100 ETH levels. These projections assume continued execution of the project roadmap and favorable market conditions for premium NFT collections.

The pudgy penguins market cap expansion during this timeframe will likely be driven by institutional adoption and integration into broader financial services. As traditional finance embraces digital assets, established NFT collections like Pudgy Penguins are positioned to benefit from increased liquidity and professional management services. Insurance products, lending protocols, and fractional ownership platforms should emerge to support higher valuations.

Technological Developments Influencing Value

Cross-chain compatibility initiatives will enhance the collection’s accessibility and trading efficiency. The successful implementation of LayerZero technology for Lil Pudgys demonstrates the team’s commitment to technological innovation. Similar upgrades for the main collection could reduce transaction costs and attract new participants, supporting higher floor prices through improved market mechanics.

Metaverse token economics will become increasingly important as virtual worlds gain mainstream adoption. Pudgy Penguins’ early positioning in this space, combined with established brand recognition, creates competitive advantages that should translate into premium valuations. The ability to seamlessly integrate NFTs across multiple platforms and applications represents significant value creation potential.

Long-Term Pudgy Penguins NFT Floor Price Prediction 2028-2030

The long-term Pudgy Penguins NFT floor price prediction extends into transformative territory as the digital asset ecosystem matures. By 2030, floor prices could potentially reach 100-200 ETH under favorable market conditions, driven by widespread adoption of Web3 technologies and the establishment of NFTs as legitimate asset classes. This represents extraordinary appreciation potential for current holders willing to maintain long-term positions.

Blockchain digital assets will likely achieve broader acceptance as stores of value and cultural artifacts during this timeframe. Pudgy Penguins, with its strong brand identity and cross-generational appeal, is well-positioned to capture value from this secular trend. The collection’s family-friendly aesthetic and positive community values align with mainstream adoption requirements, supporting premium valuations relative to more niche or controversial projects.

Factors Supporting Extreme Upside Scenarios

NFT collection valuation methodologies will become more sophisticated as the market matures, potentially revealing significant undervaluation in current prices. Traditional art market comparisons suggest established digital collections could command valuations comparable to physical collectibles, implying substantial upside potential. The provable scarcity and cultural significance of Pudgy Penguins position it favorably for such revaluations.

Generational wealth transfer could create unprecedented demand for digital assets as younger demographics inherit significant capital. Pudgy Penguins’ appeal to both current and future generations of collectors provides a unique advantage in capturing this demographic shift. The emotional connection and cultural relevance of the brand should support sustained premium valuations throughout this transition period.

Also Read: Blue Chip NFT Airdrop Opportunities How to Earn Passive Income 2025

Risk Factors and Bearish Scenarios

While the Pudgy Penguins NFT floor price prediction presents compelling upside potential, prudent investors must consider various risk factors that could impact valuations. Broader cryptocurrency market downturns historically affect NFT prices disproportionately, potentially causing significant short-term value declines even for high-quality collections like Pudgy Penguins.

Regulatory developments present ongoing uncertainty for digital asset markets. Potential government interventions, taxation changes, or trading restrictions could materially impact NFT valuations and market liquidity. However, Pudgy Penguins’ mainstream partnerships and family-friendly positioning may provide some protection against targeted regulatory actions compared to more controversial projects.

Competitive Landscape Challenges

The ethereum NFT investment space continues evolving rapidly, with new collections and innovative projects constantly entering the market. While Pudgy Penguins has established strong brand recognition, maintaining market share requires continued innovation and community engagement. Failure to execute planned developments or loss of community support could result in relative underperformance compared to other premium collections.

Technology risks, including smart contract vulnerabilities or blockchain infrastructure problems, could impact the entire NFT ecosystem. While established collections like Pudgy Penguins benefit from battle-tested code and security audits, unforeseen technical issues remain possible. Investors should consider these systemic risks when making long-term investment decisions.

Investment Strategies for Pudgy Penguins NFT Collectors

Developing effective strategies for pudgy penguins price analysis requires understanding both quantitative metrics and qualitative factors driving value appreciation. Dollar-cost averaging approaches can help mitigate timing risks while building positions over time. This strategy proves particularly effective for NFT collections with strong fundamental value propositions and long-term growth potential.

Trait-based investing offers opportunities for enhanced returns through careful selection of undervalued characteristics. Historical sales data reveals certain attributes consistently command premium prices, while others may be temporarily undervalued by the market. Sophisticated collectors can leverage this information to optimize their portfolio compositions and maximize return potential.

Portfolio Diversification Considerations

While Pudgy Penguins represents an excellent Web3 investment opportunity, prudent portfolio management requires appropriate diversification across different asset classes and risk levels. Allocating excessive capital to any single NFT collection, regardless of quality, exposes investors to unnecessary concentration risk. Professional investment advisors typically recommend limiting NFT exposure to 5-10% of total investment portfolios.

Cross-collection diversification within the NFT space can help reduce specific project risks while maintaining exposure to the overall market growth. Combining Pudgy Penguins holdings with other established collections, emerging projects, and utility-focused tokens creates more robust risk-adjusted return profiles. This approach captures upside potential while providing protection against individual project failures.

Technical Analysis and Chart Patterns

Cryptocurrency market analysis techniques apply effectively to NFT floor price movements, providing valuable insights for timing investment decisions. Pudgy Penguins has demonstrated clear support and resistance levels throughout its trading history, with major psychological price points at 10 ETH, 20 ETH, and 30 ETH serving as key technical indicators.

Moving average analysis reveals strong upward trends in longer timeframes despite short-term volatility. The 50-day and 200-day moving averages provide reliable trend identification tools for NFT investors seeking to optimize entry and exit timing. Recent price action suggests consolidation phases often precede significant breakout movements in either direction.

Volume and Momentum Indicators

Trading volume patterns offer crucial insights into market sentiment and future price direction. Sustained high-volume periods typically coincide with major price movements, while low-volume consolidation suggests accumulation phases. Pudgy Penguins has consistently maintained healthy trading volumes relative to other premium NFT collections, indicating strong market interest and liquidity.

Momentum oscillators help identify overbought and oversold conditions that often precede price reversals. The Relative Strength Index (RSI) and other technical indicators can guide tactical trading decisions around core long-term positions. However, NFT markets often exhibit different characteristics compared to traditional financial markets, requiring adapted analytical approaches.

Impact of PENGU Token on NFT Valuations

The relationship between PENGU token value and NFT floor prices creates complex dynamics that investors must understand for accurate Pudgy Penguins NFT floor price prediction. Token airdrops effectively provided NFT holders with additional value equivalent to 86.3% of their total airdrop benefits, creating strong incentives for continued NFT ownership and collection expansion.

Future token utility developments will likely strengthen this relationship as PENGU becomes more integrated into the Pudgy ecosystem. Governance rights, staking rewards, and exclusive access privileges tied to token holdings should create sustained demand from NFT collectors seeking to maximize their ecosystem participation benefits.

Tokenomics and Value Accrual Mechanisms

Metaverse token economics principles suggest successful implementation of utility features can create significant value feedback loops between tokens and underlying NFTs. As Pudgy World and other platform features launch, PENGU token consumption and burning mechanisms could reduce token supply while increasing demand, benefiting both token holders and NFT collectors simultaneously.

The cross-chain nature of PENGU deployment on multiple blockchains expands the potential user base and market accessibility. This broader reach should support higher valuations for both tokens and NFTs as adoption grows across different blockchain ecosystems. Strategic partnerships and integrations amplify these network effects further.

Conclusion

The comprehensive Pudgy Penguins NFT floor price prediction analysis reveals compelling investment opportunities driven by strong fundamentals, expanding utility, and favorable market positioning. Short-term projections suggest potential appreciation to 25-35 ETH by 2025, while long-term scenarios envision floor prices reaching 100-200 ETH by 2030 under optimal conditions.

Conservative investors should consider gradual accumulation strategies that minimize timing risks while capturing long-term value appreciation. The combination of established brand recognition, growing utility, and expanding ecosystem creates multiple value drivers supporting sustained price growth over the coming years.

Take action today by conducting your own Pudgy Penguins NFT floor price prediction research and consider adding these iconic digital assets to your investment portfolio. Whether you’re a seasoned NFT collector or exploring your first Web3 investment opportunity, Pudgy Penguins offers an excellent entry point into the evolving digital collectibles market with significant upside potential and strong community support.